Find Out How Much You Can Save on Debt Relief

Your path to Debt freedom

We make the debt relief process simple and stress-free. Here’s how it works:

Step 1: Free consultation

Tell us about your debt situation, and our experts will provide a personalized plan tailored to your needs.

Step 2: Review your savings estimate

We’ll show you how much you could save and outline the best strategy for reducing your debt.

Step 3: Enroll in the program

Once you decide to move forward, we’ll handle the negotiations and work with your creditors on your behalf.

Step 4: Lower monthly payments begin

You start making affordable, consolidated payments while we work on settling your debts.

Step 5: Debt Resolved!

As settlements are reached, your debts are cleared - bringing you closer to financial freedom.

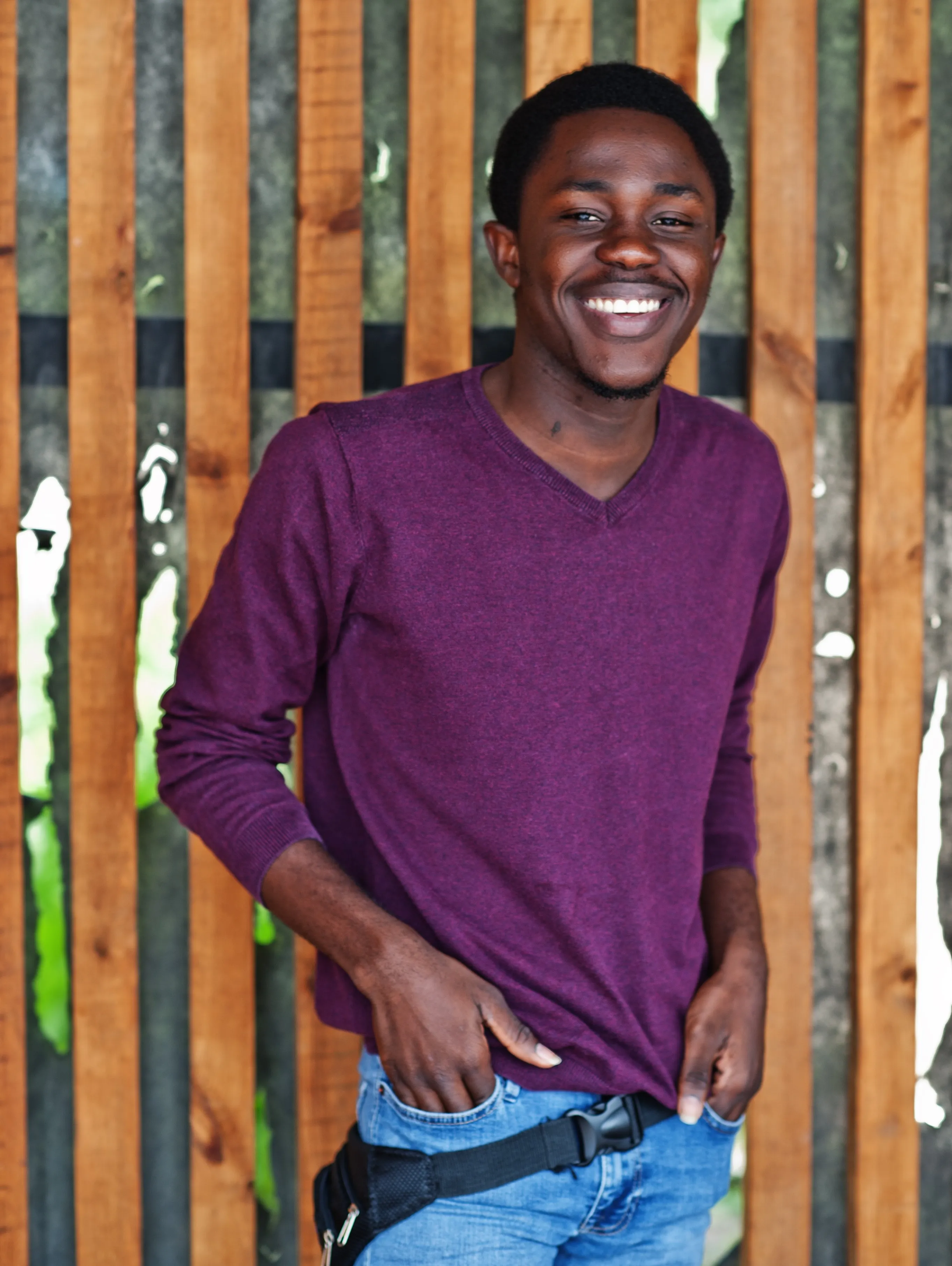

Reviews from our

Top clients

We’ve helped thousands — here are their success stories

“Our mission is to empower you to overcome debt and take back control of your finances. Our team is committed to finding effective solutions that create a lasting impact on your journey to financial freedom.”

Who is Debt Relief for?

Our program is designed to help if you:

Have significant debt and are struggling to keep up with payments.

Miss payments regularly or are at risk of being contacted by collection agencies.

Worry about your credit score and want to avoid bankruptcy.

Are looking for a legal and safe way to reduce your debt burden.

Want to regain financial stability and start a new chapter in your life.

Must-read financial tips

FAQs

Does debt restructuring affect my credit score?

No, our programs are specifically designed to protect your credit score.

How much can I save?

Most Americans reduce their debt by up to 70%. The exact amount depends on your situation.

How long does the process take?

The process usually takes 1–2 weeks, depending on the complexity of your case.

How do I know if this program is right for me?

Call us for a free consultation, and we’ll help you find out!